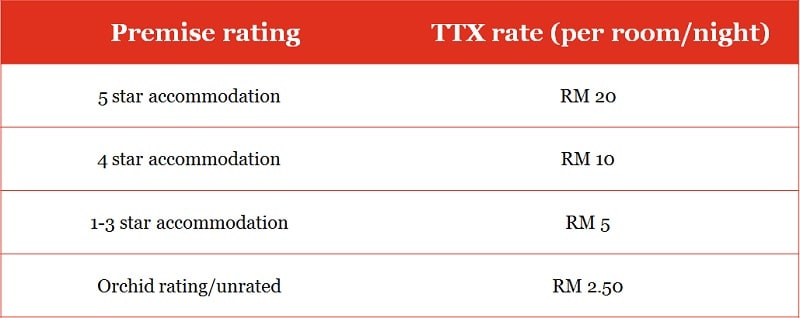

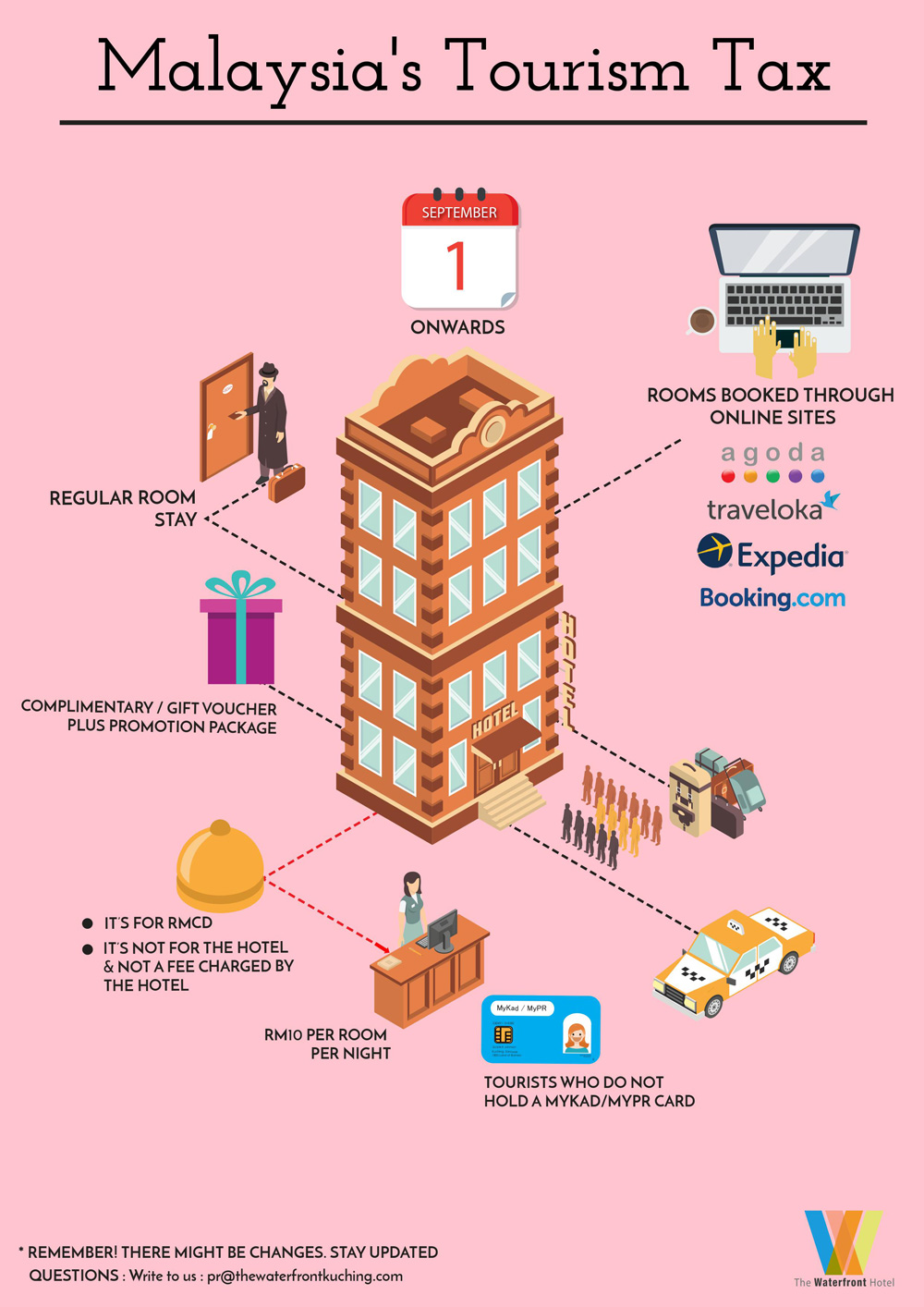

ROYAL MALAYSIAN CUSTOMS DEPARTMENT LEVEL 4 BLOCK A MENARA TULUS NO 22 PERSIARAN PERDANA PRECINCT 3 62100 PUTRAJAYA FEDERAL TERRITORY MALAYSIA https. The TTx has also been set at a flat rate of RM10 per night per room rented.

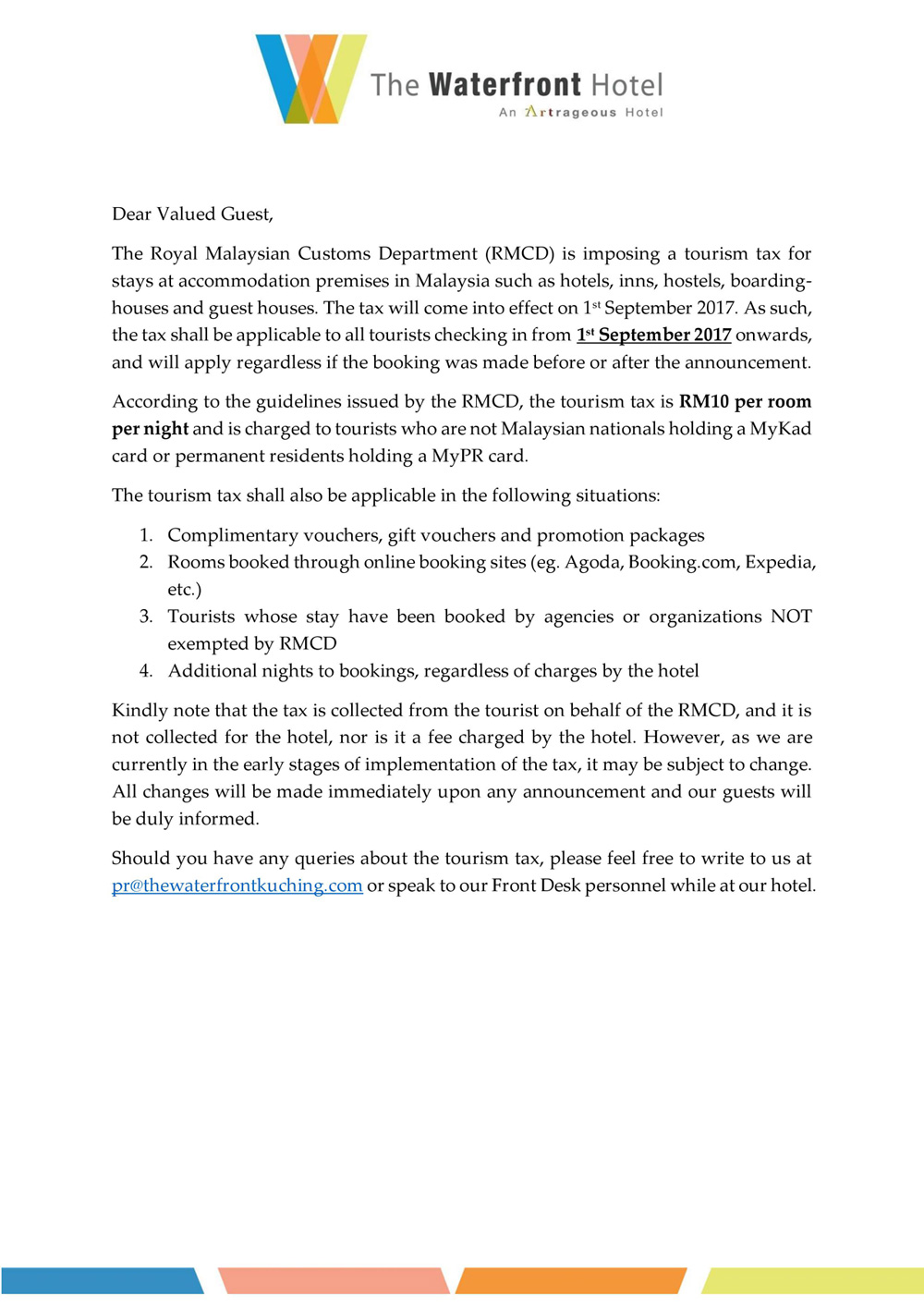

Malaysian Tourism Tax The Waterfront Hotel

2 Tower 1 Jalan P56 Presint 5 62200 PUTRAJAYA 03 8000 8000 03 8891 7100 infomotacgovmy.

. Penang RM3 per room night 4- and 5-star hotels RM2 per room night for 3-star and below including all dorms budget hotels hostels and guesthouses. Read the Department of States COVID-19 page before planning any international travel and read the Embassy COVID-19. The tax is intended to tax consumers who rent accommodation within Malaysia and it is for this reason these taxes have also been called occupancy taxes The concept of a TTx is not a new one and similar taxes are collected by various cities across the United States.

The Income Tax Exemption No. BACKGROUND OF TOURISM TAX 2. What is the Tourism Tax.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. FAQs on tourism tax and bookings via online. To tax tourism or more accurately occupancy.

Level 3 MaTIC New Building 109 Jalan Ampang 50450 Kuala Lumpur Malaysia. This tax will be imposed in addition to GST on both local and foreign tourists staying at any accommodation premises. Online booking accommodation premises to a tourist relating to the implementation of Tourism Tax TTx.

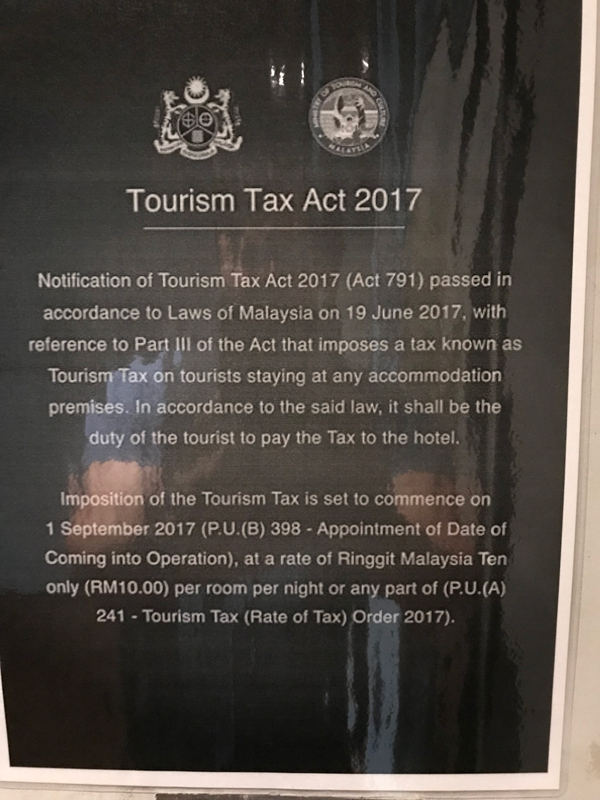

Regarding the tourism tax for accommodation premise operatives the tax now applies innovative accommodations such as tent-type hotels caravans containers boathouses treehouses sleeping tubes tents cruises and such similar accommodations. Service chargeProperty tax. A Tourism Tax Act 2017.

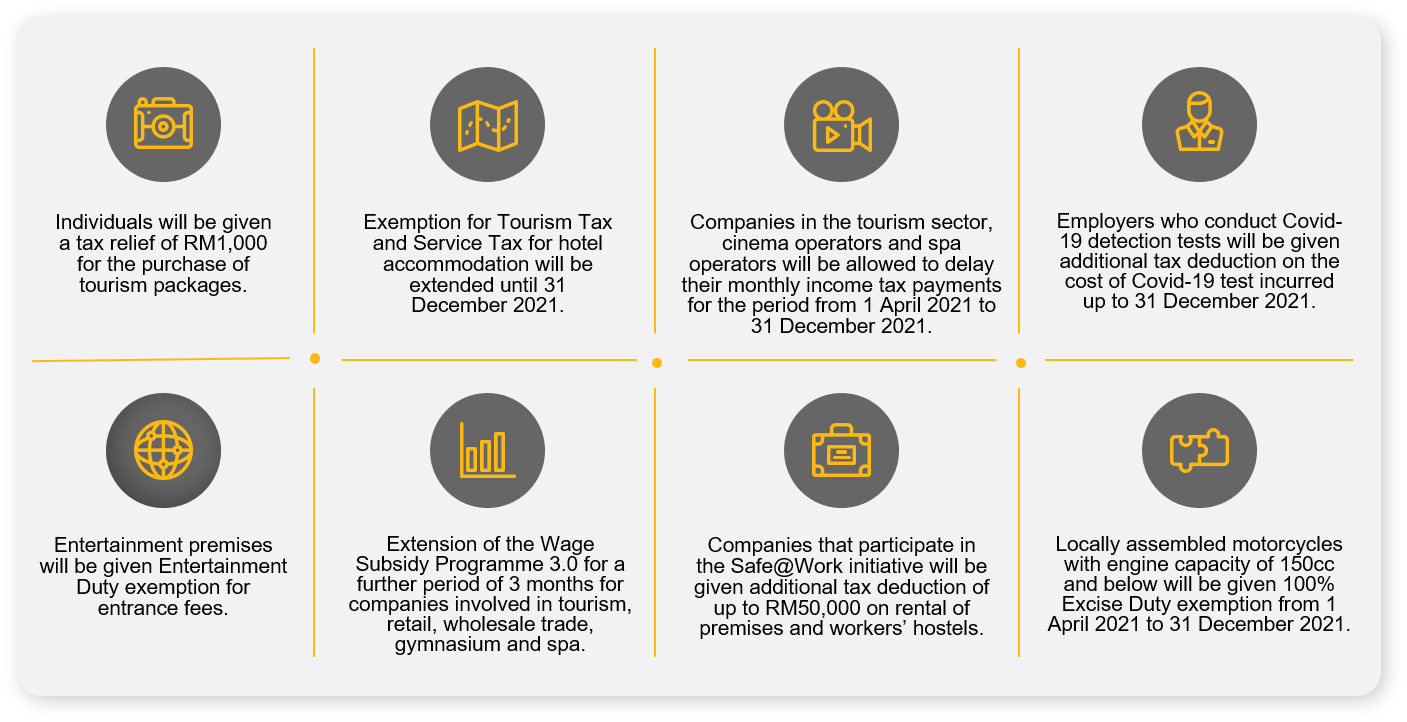

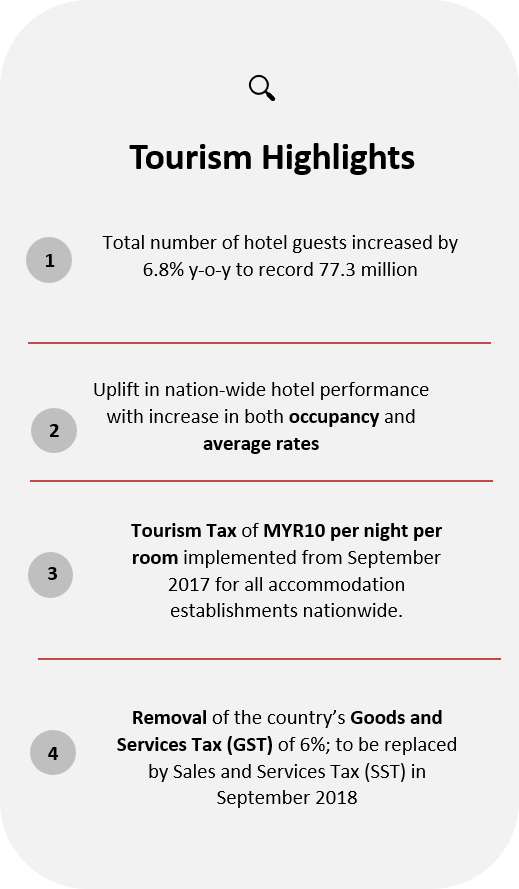

KUALA LUMPUR Oct 30 The extension for tourism tax exemption until December 31 through the presentation of Budget 2022 in the Dewan Rakyat yesterday will help revive the tourism industry in the three Federal Territories. Foreign tourists are charged a flat rate of RM10 S320. 9 has effect from the year of assessment 2021 until the year of assessment 2022.

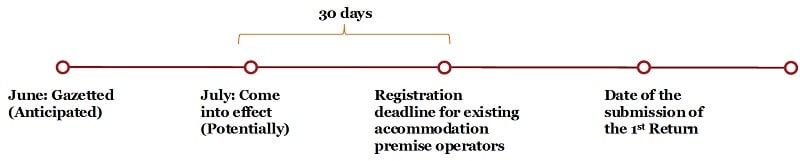

6 on room rate. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. An obligation to charge Malaysias tourism tax TTx and remit the tax to the tax authorities currently is scheduled to apply as from 1 January 2022 to digital platform service providers DPSPs that provide online booking services for accommodations in Malaysia regardless of whether the DPSP is a resident of Malaysia or a nonresident.

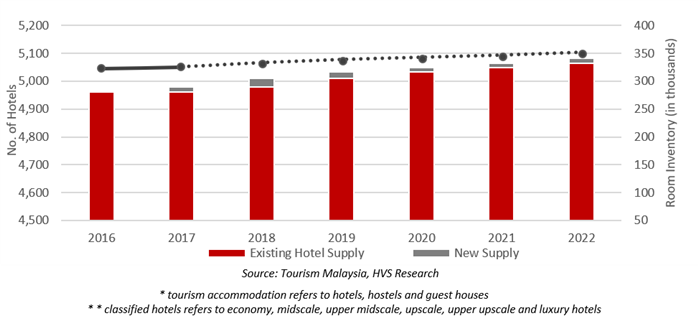

Grants soft loans and tax incentives are needed to revamp and revive the tourism industry says the Malaysian Association of Hotels MAH which hopes the government will look into. The latest data available from the MyTourismData portal of the Tourism Malaysia website stated that there are 4799 hotels and 304721 rooms in the country as of 2015. The Centers for Disease Control and Prevention CDC has determined Malaysia has a high level of COVID-19.

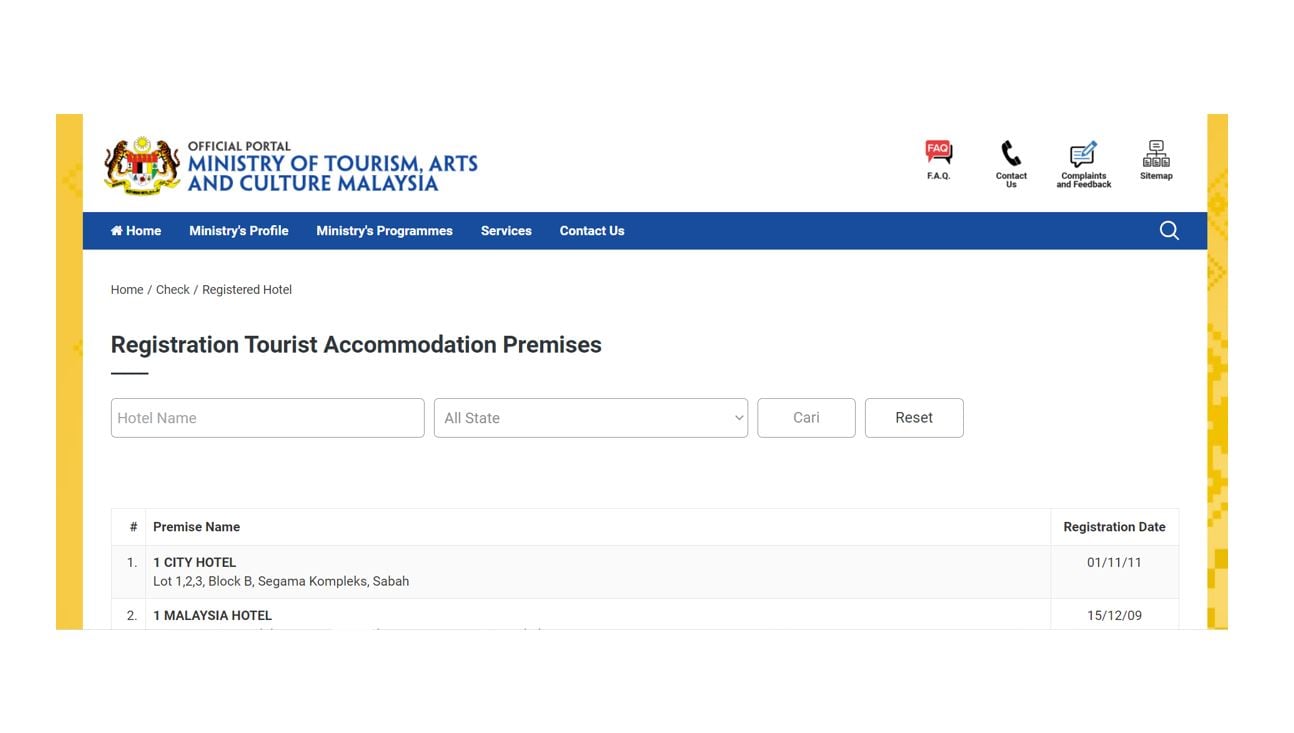

If you had booked a hotel or visited a tourist attraction in Malaysia during 2021 you could be eligible for an income tax relief of up to RM1000 on the expenses. 1 CITY HOTEL Lot 123 Block B Segama Kompleks Sabah. This rate was fixed in September 2017 compared to.

Visit the CDC page for the latest Travel Health Information related to your travel. Goods and services tax. 1 MALAYSIA HOTEL Lot S0110-0115 Blok J.

EVENT CALENDAR Check out whats happening. The Royal Malaysian Customs Department on 20 January 2021 issued a set of frequently asked questions FAQs about the tourism tax and specifically addressing the expanded scope of the tourism tax regarding accommodations booked via an online platform. Read an August 2021 report prepared by the KPMG member firm in Malaysia.

For starters its good to remember that in Malaysia tourism taxes also known as TTx are only collected by owners of accommodation for the rental of these spaces and are usually labelled clearly in bills. The responsibility for collecting the tax will be borne by the. Contact Us Ministry of Tourism Arts and Culture No.

If you decide to travel to Malaysia. C Tourism Tax Digital Platform Service Provider Regulations 2021. COMPLAINT.

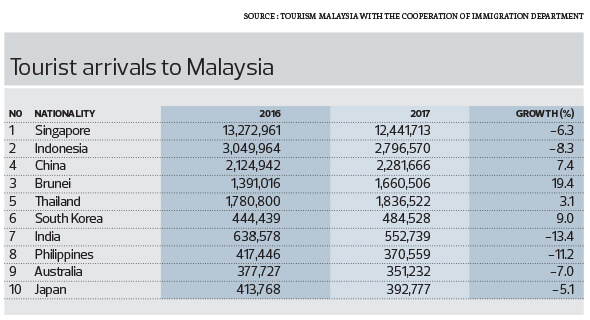

9 was gazetted on 23 August 2021EO. PETALING JAYA THE STARASIA NEWS NETWORK - Some 5000 hotels around Malaysia have started implementing the tourism tax for foreigners. Malaysias tourist tax comes into effect 1 August 2017.

IStock The tax will be imposed on all visitors both foreign tourists and Malaysian nationals staying in accommodation for either leisure religious holiday or business purposes. Heritage taxsurchargelocal government fee varies from location to location. 9 exempts a qualifying person from the payment of income tax in a basis period for a year of assessment in respect of the statutory income derived from a.

B Tourism Tax Amendment Act 2021. The estimated revenue to be raised from this tourism tax is RM65462 million assuming 60 occupancy rate of the 11 million room nights available in Malaysia. Premise Name Registration Date.

As you may recall the special tourism tax relief that was announced under the Economic Stimulus Package 2020 originally for March to August 2020 had been extended up until. The implementation of TTx is provided for under the following legislation. Federal Territories Minister Datuk Seri Shahidan Kassim said the exemption of entertainment duty in the entertainment.

9 Order 2021 PU A 3442021 EO. AGENCY Browse other government agencies and NGOs websites from the list. 10 on room rate.

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Pemerkasa Assistance Package Crowe Malaysia Plt

Hvs In Focus Malaysia Reinvigorated Opportunities

Pdf Medical Tourism In Malaysia International Movement Of Healthcare Consumers And The Commodification Of Healthcare

The State Of The Nation Reversing The Declining Trend In Tourist Arrivals The Edge Markets

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Guide To Tax Refund In Malaysia Bragmybag

Myttx Malaysia Tourism Tax System

Special Personal Income Tax Relief Up To Rm 1 000 For Domestic Travels Sunway Travel Sdn Bhd

Malaysian Tourism Tax The Waterfront Hotel

Domestic Travel Tax Relief Perks That Malaysians Can Enjoy In 2022

The 5 Best Areas To Stay In Kuala Lumpur For Your First Epic Visit To Malaysia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Hvs In Focus Malaysia Reinvigorated Opportunities

The Malaysia Tourism Tax Bill 2017 With Autocount Software